The pipeline of new drugs coming to market continues to be steady, with 50 novel drugs approved by the FDA in 2021.[1] A number of these drugs are more costly specialty medications that treat chronic and rare diseases, such as rheumatoid arthritis, psoriasis, multiple sclerosis and various cancers. While overall utilization of specialty drugs is only around 1%, specialty drugs contribute to nearly half of overall drug spend.[2] In fact, specialty spend in the U.S. was $245 billion in 2019, with nearly a fourth of this amount being directly attributed to the rare/orphan drug space.[3] Some analyses have demonstrated that the average cost per specialty claim is about $5,000.[4] With these kinds of expenses, plan sponsors are looking for ways to manage specialty spend. In this first of a four-part series, we will review solutions used at Elixir for managing the growing specialty drug pipeline.

Monitoring Even Before FDA Approval

An important part of managing specialty spend is knowing what’s on the horizon and understanding how various pipeline nuances (such as biosimilars and authorized generics) can impact drug spend downstream if not managed appropriately. At Elixir, our team of clinical pharmacists monitors and reviews drugs prior to FDA approval, including those receiving a new indication, tracking numerous pharmaceutical agents throughout the research and development process. Take for example a fictional drug we will call LxR-CUR. Our Clinical team began monitoring LxR-CUR early on during the research and development phase, following the clinical trials to gain an understanding of clinical efficacy and its potential place in therapy.

The New Drug on the Block

So what happens after a drug is approved? At Elixir, a report of newly launched drugs is generated and reviewed by our clinical pharmacists weekly. In this report, we see that our fictional drug LxR-CUR has launched! Like many newly launched drugs—both specialty and non-specialty—LxR-CUR is now going to go through our New-to-Market Block process. As the name implies, this process blocks prescriptions for new medications from processing through the pharmacy benefit until our Clinical team has had sufficient time to review and analyze all of the data associated with it. This includes clinical trial data and published consensus guidelines.

The steps involved in this review are critical in order to fully understand a drug’s place in therapy, as well as proper formulary placement and utilization management strategies to ensure the most appropriate and cost-effective use of LxR-CUR for members (more on this in the next part of our series).

This proactive preparedness also protects our clients from unnecessary spend. Think of the waste that would be involved if a drug was allowed to process through the system immediately after it launched, only to discover weeks later that the drug should have had strict prior authorization criteria applied. An even worse scenario would be if it was determined that there is insufficient evidence to support coverage at all! A recent example of this is with the Alzheimer’s drug Aduhelm, which was approved via the FDA’s accelerated approval pathway. The New-to-Market Block process allowed for adequate time to analyze all of the data and ultimately determine to exclude this drug from the pharmacy benefit due to insufficient evidence. These decisions help mitigate risk for our clients, reduce excess spend and ensure appropriate use of medications to protect clients and members alike.

The Path to Formulary Placement

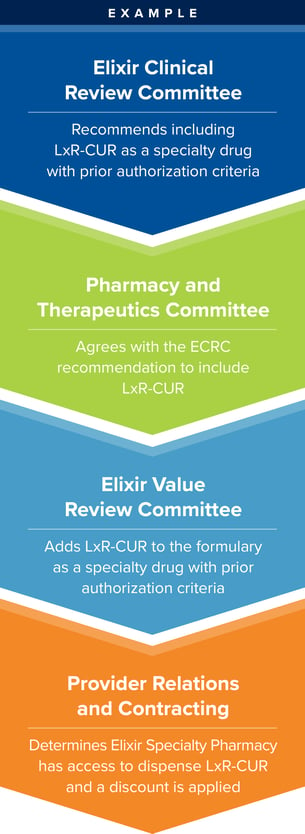

Let’s take a closer look at this New-to-Market Block process and the individual steps involved as it pertains to our fictional drug LxR-CUR.

Elixir Clinical Review Committee (ECRC)

Elixir Clinical Review Committee (ECRC)

Elixir’s Drug Information Pharmacists, who have been following the development of LxR-CUR, present all of the clinical trial data, information from evidence-based literature, and safety and efficacy profiles to this internal committee comprised of clinical pharmacists from various teams throughout Elixir. The committee reviews the information and votes whether to include the drug, exclude (such as when there is insufficient evidence) or make formulary coverage optional. Initial utilization management strategies are also discussed.

Pharmacy & Therapeutics Committee (P&T)

Next up, P&T. The P&T Committee, comprised of external clinicians representing a variety of specialties and select ECRC members, has a mission of ensuring access to clinically appropriate, safe and cost-effective drug therapies. The committee reviews recommendations provided by the ECRC and applies their clinical expertise to provide their recommendation regarding LxR-CUR.

Elixir Value Review Committee (EVRC)

It is then the task of the EVRC to assess economic impact and the member experience to solidify LxR-CUR’s place in therapy. This internal committee, comprised of employees from throughout the organization analyzes the competitive market and uses the P&T Committee’s decision to determine formulary placement.

Provider Relations & Contracting

Now that LxR-CUR has been determined to be included as a specialty drug under the prescription benefit, the Provider Relations & Contracting team, comprised of pharmacy network specialists, assesses the drug's availability in the market, with competitive discount offerings for limited distribution products. They develop performance criteria for strategic network participation and secure specialty pharmacy procurement through agreements and contracting.

With so many new medications coming to market, particularly pricey specialty medications, it is important to thoroughly assess new drugs with a thoughtful approach. Elixir’s New-to-Market Block and comprehensive review process ensure newly approved drugs are properly evaluated to balance clinical effectiveness, economic impact and the member experience.

In the next part of the series, we will continue to follow our fictional drug LxR-CUR with a focus on clinical cost-effectiveness, namely, the development of appropriate prior authorization criteria, program placement and other utilization management strategies.

[1] U.S. Food & Drug Administration. Novel Drug Approvals for 2021. https://www.fda.gov/drugs/new-drugs-fda-cders-new-molecular-entities-and-new-therapeutic-biological-products/novel-drug-approvals-2021.

[2] Seymore, Brandeis (2020). Challenges of Channel Management for Specialty: Medical Benefit or Pharmacy Benefit. Pharmacy Times. July 10, 2020. https://www.pharmacytimes.com/view/challenges-of-channel-management-for-specialty-medical-benefit-or-pharmacy-benefit.

[3] IQVIA Institute (2020). FDA Orphan Drug Designations and Approvals. IQVIA National Sales Perspective, Jan 2020.

[4] U.S. Pharmacist (2021). Net Spending on Specialty Pharmaceuticals Surging. https://www.uspharmacist.com/article/net-spending-on-specialty-pharmaceuticals-surging.