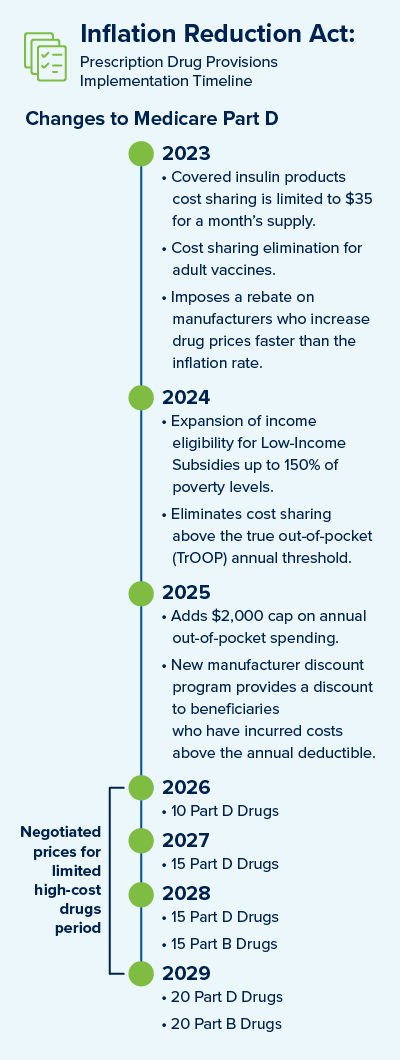

On August 16th, 2022, President Biden signed into law H.R. 5376, a budget reconciliation measure known as the Inflation Reduction Act (IRA). The IRA makes wide-reaching changes to healthcare, specifically to Medicare prescription drug coverage. The IRA also includes other provisions to address energy and climate policy changes. Key provisions for drug coverage changes are summarized below.

New for current year 2023

- Covered Insulin Products – Cost sharing is limited to $35 for a one month supply.

- Adult Vaccines for Medicare Part D - Eliminates the cost sharing for adult vaccines. It also requires states to cover all vaccines for Medicaid and Children’s Health Insurance Program beneficiaries. The benefit only applies to any vaccines that are cleared by the Centers for Disease Control and Prevention's (CDC) Advisory Committee on Immunization Practices (ACIP).

- Potential Penalties to Manufacturers – The IRA imposes a rebate on manufacturers who increase drug prices faster than the inflation rate. The benchmark for the inflationary rebates would be based on 2021 prices. With respect to Part D, the manufacturer rebate will be first due for the period of 10/1/2022 to 9/30/2023.

Upcoming for calendar year 2024

- Expands Eligibility for Low-Income Part D Subsidies – The IRA expands income eligibility for the Low-Income Subsidy (LIS) program, up to 150% of poverty levels.

- Eliminates Cost Sharing – The IRA eliminates cost sharing above the true out-of-pocket annual threshold (TrOOP).

Changes to be implemented in calendar year 2025

- Medicare Part D Benefit Redesign – The coverage gap will be eliminated, and manufacturers will be subject to mandatory discounts on brand drugs in the initial coverage and catastrophic coverage phases.

- Increase to Out-Of-Pocket Spending – The IRA adds a $2,000 cap on annual out-of-pocket spending.

Changes planned for calendar years 2026 to 2029

- Medicare Prescription Drug Price Negotiation – The IRA requires the Department of Health and Human Services to negotiate prices for some high-cost drugs covered under Medicare. Selected drugs will be subject to mandatory price negotiations under Medicare beginning in 2026, with negotiated prices subject to a cap. The number of drugs selected for negotiation increases from 10 in 2026 to 20 in 2029 and subsequent years, with selected drugs generally retaining that status until a generic or biosimilar enters the market.

With the passage of the IRA, implementation of these pricing reforms now becomes the main focus. It is up to Medicare to ensure that selecting drugs to be negotiated and that the evidence supporting these choices is clear. The IRA also further delays the Part D Rebate Rule, which has not gone into effect, to CY 2032.

Elixir will continue to monitor all new guidance related to the IRA and its impact to the Medicare prescription drug benefit. Please contact your designated Elixir Account Manager or Compliance Officer if you have any questions.

UPDATE: CMS released updated Program and PDE Guidance on 9/26/2022. Elixir is reviewing the new guidance and will provide a separate communication to our clients.

References:

https://www.congress.gov/bill/117th-congress/house-bill/5376/text

https://www.cms.gov/newsroom/press-releases/statements-cms-leadership-president-biden-signing-inflation-reduction-act-law

https://www.hhs.gov/about/news/2022/08/16/statements-hhs-secretary-xavier-becerra-cms-administrator-chiquita-brooks-lasure-on-president-biden-signing-inflation-reduction-act-into-law.html